Discovering New York City Residential Or Commercial Property Financial Investment Opportunities: A Overview for Savvy Investors

New York is a prime place for building investors, providing varied financial investment opportunities across its metropolitan facilities, residential areas, and picturesque rural areas. The state's dynamic property market brings in a range of investors, from those thinking about high-yield rental properties to those focusing on lasting possession development with industrial or domestic growths. Understanding New York's investment landscape, crucial regions, and property types will equip investors with the insights required to browse this affordable and lucrative market.

Why Buy New York Real Estate?

New York supplies a number of compelling reasons for home financial investment:

High Demand: With NYC as a international company hub, rental demand remains durable. The state's household and business properties satisfy a series of requirements-- from households and students to professionals and businesses.

Diverse Market: Capitalists can discover lucrative opportunities in a selection of industries, consisting of industrial, domestic, commercial, and retail.

Expanding Populace Centers: Upstate New York's population facilities and NYC's 5 boroughs draw in individuals with occupation chances, quality of life, and facilities, contributing to property gratitude and rental demand.

Possible Tax Motivations: Specific zones in New york city offer tax benefits, which can be useful for long-lasting property financial investments and developments.

Leading New York Home Investment Markets

1. New York City City (NYC).

New york city is a significant tourist attraction for real estate financiers, with areas across the 5 boroughs supplying varying degrees of investment capacity.

Residential Rental Characteristics: New York City's high population density and consistent increase of new homeowners make it a prime spot for rental investments. Areas like Brooklyn and Queens, in particular, see high need for services, making them eye-catching for multifamily financial investments.

Commercial Real Estate: Office and retail area continue to be solid assets in Manhattan, especially in industrial areas like Downtown and Wall Street. Post-pandemic, there's likewise require for versatile office spaces.

Deluxe Developments: Areas like the Upper East Side and Tribeca continue to attract high-net-worth individuals, making luxury houses and apartments a profitable financial investment.

2. Long Island.

Close to New York City, Long Island offers suburban living with closeness to the city, making it a favored for families and specialists seeking a quieter environment.

Single-Family Residences: Long Island's Nassau and Suffolk areas are popular for single-family homes, particularly in suburban areas. These areas attract family members seeking high quality college districts and safe neighborhoods.

Seasonal Rentals: The Hamptons and Fire Island are hot spots for getaway rentals, especially in the summertime. Seasonal rental buildings in these locations supply exceptional rois.

Multifamily Housing: With restricted housing availability in New York City, Long Island's multifamily devices supply an economical alternative for those travelling to the city, making these properties a profitable financial investment choice.

3. Hudson Valley and Upstate New York.

For capitalists curious about even more cost effective real estate with capacity for recognition, Hudson Valley and Upstate New york city supply different chances.

Rental Properties: The Hudson Valley's distance to NYC makes it a prominent option for commuters and remote workers. Cities like Sign, New Paltz, and Kingston have actually seen boosted need for services and second homes.

Tourism and Vacation Features: With scenic landscapes and outdoor leisure activities, areas around the Adirondacks, Finger Lakes, and Catskills bring in travelers year-round, making short-term leasings successful.

Trainee Housing: Albany, Syracuse, and Rochester are home to major colleges. Financiers in these cities can take advantage of the consistent demand for pupil housing by acquiring multifamily or studio apartment buildings.

4. Albany.

New York's resources uses a stable realty market with opportunities in property and commercial markets. Its constant economic climate, bolstered by government work and tech start-ups, makes Albany an eye-catching place for rental residential property financial investments.

Multifamily Investments: Albany's multifamily units, specifically around government offices and universities, are in need by students, experts, and family members.

Commercial Area: Albany's economic situation is evolving, with growth in the modern technology sector producing need for office and coworking environments.

Single-Family Houses: Albany's areas provide price and a slower pace than New York City, attracting households and senior citizens trying to find cost effective housing.

Methods for Successful https://sites.google.com/view/real-estate-develop-investment/ Property Financial Investment in New York.

For financiers intending to maximize New york city's competitive market, right here are some workable approaches:.

1. Evaluate Market Trends by Location.

Each area of New York has special financial drivers and residential or commercial property demand. Completely investigating the certain city or area can expose understandings right into lasting productivity. As an example, while NYC offers high rental yields, Upstate New York might give far better lasting admiration possibilities.

2. Understand Regional Laws.

New York has various residential or commercial property regulations, especially regarding rental homes. NYC, for instance, has specific rules for temporary leasings, zoning, and occupant civil liberties. Recognizing these guidelines assists investors stay clear of penalties and legal obstacles.

3. Focus on Rental Demand.

Rental need is strong in urban and suburbs alike, supplying outstanding opportunities for consistent revenue. By focusing on rental residential or commercial properties-- whether short-term, mid-term, or long-lasting-- investors can capitalize on regular cash flow. In locations like the Hamptons and Hudson Valley, seasonal services can likewise provide substantial earnings.

4. Take Into Consideration Residential Property Management.

If buying regions much from NYC, building administration is crucial for remote proprietors. Hiring a trusted home monitoring firm assists keep rental residential properties, handle lessees, and manage day-to-day procedures. This technique ensures a positive rental experience and minimizes the capitalist's hands-on time commitment.

5. Take Advantage Of Funding Alternatives.

Safeguarding financing is essential, particularly in open markets like NYC. Financiers can gain from financing choices such as home loan, business lendings, and collaborations, which can assist make the most of acquiring power and boost returns.

Future Trends in New York Real Estate Investment.

As New york city's realty market advances, capitalists can anticipate new possibilities and difficulties:.

Remote Job Influence: The surge of remote work has reshaped real estate need, particularly in country and Upstate areas, as individuals search for even more inexpensive options outside New York City.

Lasting Advancement: Environment-friendly developments and environment-friendly buildings are obtaining popularity, specifically in metropolitan facilities. Features with sustainable attributes may attract eco aware lessees and customers.

Raised Passion in Additional Cities: Cities like Albany, Buffalo, and Rochester are drawing interest for their economical homes and improving local economic situations, developing financial investment capacity beyond New York City.

New york city's realty market offers diverse home investment opportunities, from Manhattan's high-rises to Hudson Valley's moving landscapes. Financiers can take New York property investment opportunities advantage of various residential property types and locations relying on their goals, be it rental income, building recognition, or long-term wide range growth. By recognizing regional market dynamics, remaining informed on regional guidelines, and choosing the appropriate residential property management approaches, investors can attain lucrative end results in one of the country's most exciting residential property markets.

Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Michael Fishman Then & Now!

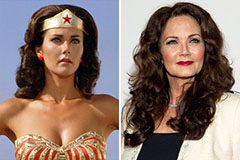

Michael Fishman Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!